The Indian Premier League (IPL) has become a global phenomenon, capturing the attention of cricket enthusiasts and investors alike. During this season, which was its 16th edition, one intriguing investment opportunity that has emerged is the trading of unlisted shares of IPL franchises, such as Chennai Super Kings (CSK). This blog will dive deep into the potential profit opportunities one can grab though buying CSK unlisted shares during the IPL off-season.

Overview – Chennai Super Kings Cricket Limited

Chennai Super Kings Cricket Limited is a public limited company headquartered in the bustling city of Tamil Nadu. It was established on December 19,2014, the company has an authorised share capital of INR 6.00 crore and a total paid-up capital of INR 3.08 crore. The range from INR 100 crore to 500 crore is a testament to its growth and success in the market. Despite a -31.80% decrease in its EBITDA over the previous year, the company’s book net worth has observed a noteworthy increase of 14.86%. Moreover, the company operates a cricket team and sells CSK-printed men’s t-shirts, mugs, and other home decor products. Also, CSK offers a variety of products, including calendars, apparel for men and women, kids’ toys, home decor and kitchen items, and collectables.

Financial Highlights Of Chennai Super Kings Cricket Limited

- The revenue of Chennai Super Kings Cricket Limited increased by 37.61% from Rs. 24,783.40 lakhs in FY 2021 to Rs. 34,105.11 lakhs in FY 2022.

- EBITDA declined by 22.96% YoY to Rs. 5122.87 lakhs in FY 2022 from Rs. 6650.10 lakhs in FY 2021.

- In FY 2022, the company’s revenue decreased to Rs. 3,212.49 lakhs from Rs. 4,026.22 lakhs in FY 2021. Additionally, PAT margins decreased from 16.24% to 9.41%.

- As of March 31, 2022, the company’s liquidity ratio was 1.46, indicating its ability to pay liabilities during emergencies easily.

- Moreover, the firm has not paid any dividends for the past three years.

- The finance cost of the firm increased by 7.84% from Rs. 526.34 lakhs to Rs. 567.65 lakhs.

- The firm’s book value on March 31 2022, was Rs. 8.05.

Revenue Model Of Chennai Super King Cricket Limited

The Chennai Super Kings sell match tickets and merchandise, among other things. In the following section, we will explore the various ways in which CSK generates revenue.

Media Rights

Media rights make up 40-50% of IPL team revenue, with BCCI earning a significant amount by selling to OTT platforms. Chennai Super Kings earned ₹201.65 crores through media rights in IPL 2022. Total media rights revenue will increase to ₹400 crores in IPL 2023.

Sponsorships

Chennai Super King earns revenue from two types of sponsors: those sponsoring IPL and those working with IPL teams. BCCI takes a cut from IPL sponsors and distributes 40-50% of it among IPL teams. Chennai Super Kings partners with brands like TVS Eurogrip, Reliance JIO, Equitas, and Gulf Oil.

Stadium Ticket Sales

Chennai Super Kings earn 15% of revenue from ticket sales. They also hire food and beverage vendors for matches. CSK sets ticket prices and revenue with sponsors and BCCI. Stadium holds 50k tickets with prices from ₹1500-₹3000.

Merchandise Sales

Merchandising is selling products directly to consumers. India’s sports equipment and apparel demand was worth over $28 billion in 2022 and is expected to grow to $40.6 billion by 2027. Chennai Super Kings partnered with ‘play’ as their official global merchandise partner in 2022. They earn revenue through partnerships with companies like Coca-Cola, ICICI Bank, Hello FM, and Sunfeast.

Prize Money

IPL prize money is one of many income sources for teams. Previous winners received ₹20 crores out of ₹46.5 crores. Runner-up got ₹13 crores. The loser of qualifier 2 gets ₹7 crores, and the losing team gets ₹6.5 crores. Chennai Super Kings earned the most. The upcoming season’s prize money has not been announced yet.

Why Should You Invest In Unlisted Shares Of CSK In Offseaon?

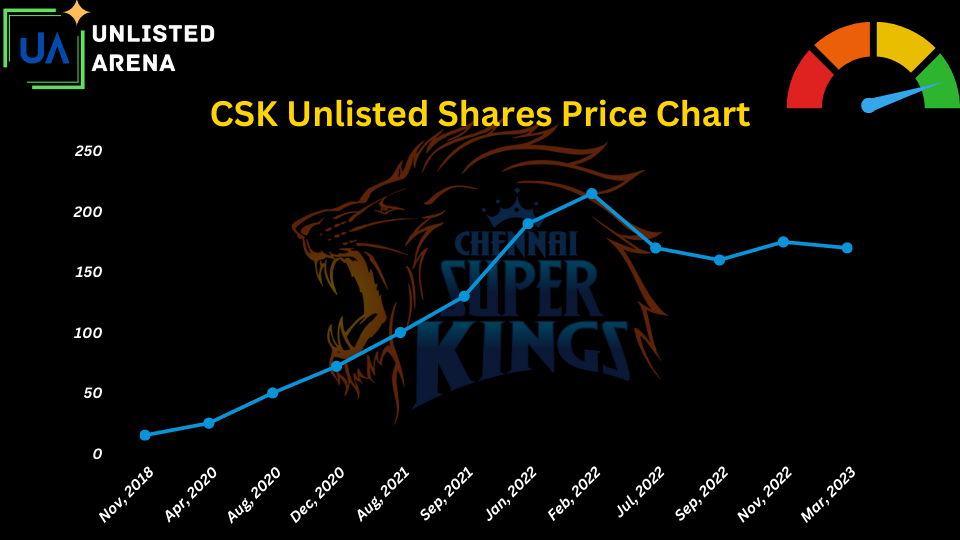

According to Forbes, the esteemed Chennai Super Kings cricket franchise is currently valued at a staggering $1.15 billion. This impressive number places them as the second highest-valued franchise in the league, just behind Mumbai Indians, which is worth $1.3 billion. In the unlisted market, the share price for CSK is currently ₹160 with approximately 36 crore outstanding shares, resulting in a market capitalisation of approximately 5700 crores. Therefore, investing in CSK unlisted shares during the offseason is beneficial. If you are wondering where to buy these shares, Stockify is the best platform for unlisted share purchases and share price news.

Bottom Line

The Chennai Super Kings is one of the most successful franchises in the Indian Premier League. They have attracted a range of sponsors from different industries, such as automotive, technology, fashion, and finance. The partnership between CSK and its sponsors is mutually beneficial. So, regardless of IPL seasons, investing in CSK unlisted share could be a smart financial decision.